The Price of Carbon Credits Varys Depending on a Variety of Factors

The Price of Carbon Credits

The price of carbon credits varies, depending on a variety of factors. These include the location of the project, the technology used, and the volume of emissions produced. Some companies produce more or less emissions than allotted credits. Others are years away from reducing their emissions enough to meet their cap. It’s difficult to measure the effect of any single factor on the price of carbon.

Buying and selling carbon credit trading is not as easy as it may sound. This is because a wide variety of projects are issuing carbon credits, which can have different impacts on the price of carbon. Fortunately, the best way to trade the right credit for the right price is to get a sense of the market.

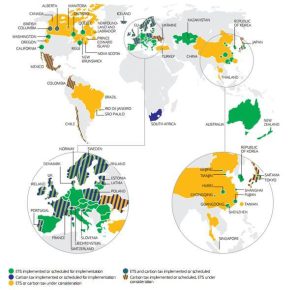

The Emission Trading Schemes, also known as cap and trade, is a regulated system that caps total levels of greenhouse gas emissions. Businesses that meet this cap are able to sell excess credits to other businesses. Traders and investors will look to these markets as a source of revenue.

The Price of Carbon Credits Varys Depending on a Variety of Factors

Carbon offsets are a good way to reduce a company’s carbon footprint. Companies can offset their emissions by investing in projects that reduce GHGs and provide additional social benefits. Examples of these projects include reforestation and restoring habitats for endangered species.

Carbon trading has been around for decades. Many countries have cap and trade systems that limit the amount of GHGs that can be emitted. In addition, these systems allow businesses to take advantage of allocating their own credits. However, many governments have set a cap on the number of permits available to the market, which limits the number of carbon credits that can be traded.

One of the simplest ways to trade carbon credits is through an exchange. Many of these companies act as brokers, buying and selling the credits in the marketplace for a commission. They usually have an arm that handles the development of these projects, as well.

While the most basic form of carbon trading is through the Emission Trading Schemes, there are more advanced forms of this same concept. For instance, the Regional Greenhouse Gas Initiative (RGGI) is a voluntary initiative formed by 12 states and New York, to limit emissions from the power sector.

Another important element of carbon trading is the market for standardized products. Several financiers have dedicated project development arms. Such products are designed to ensure that the key characteristics of the underlying project are respected.

However, these standardized products are often not as well priced as their unstandardized counterparts. There are other more sophisticated mechanisms of pricing carbon credits, such as the Emission Trading Schemes and the voluntary market. Both have their own advantages and disadvantages, which we’ll touch on shortly.

A broader view of carbon trading is to say that the most important factor determining the price of carbon is the geography of the underlying project. For example, industrial projects are often the best producers of large volumes of credits, whereas community-based projects, which are typically localized, have the most potential to generate co-benefits.