What Are Carbon Credits Commodities?

Carbon Credits Commodities

Carbon credits are carbon dioxide emissions that have been allocated to a company in a particular jurisdiction. They act as an incentive for companies to reduce their greenhouse gas emissions. They are also a way to measure how much reduction a company has made in its emissions. Companies that meet their quotas and avoid cheating are rewarded with credits. However, this is not a mandated system and the number of credits a company receives is set by regulatory agencies.

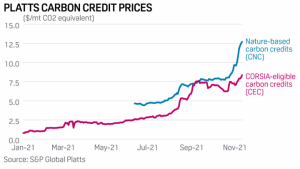

While carbon.credit are an effective tool for businesses to offset their emissions, they are not a foolproof method of doing so. Some companies do not produce as much carbon dioxide as they are allotted. There are a number of factors that can affect the quality of a carbon credit. In addition, the price of a carbon credit depends on supply and demand. When there is a glut of credits, the price per tonne of credits will decrease.

The best cap and trade programs will provide a clear framework for businesses to meet their emission reduction targets. These regulations allow companies to use the market to purchase and sell credits. Typically, these credits are sold for a premium. Other credits, such as renewable fuel credits, are traded in the open market.

What Are Carbon Credits Commodities?

There are two types of carbon markets, the voluntary and the mandatory. The voluntary carbon market is not mandated, but it is more accessible to farmers, landowners and ranchers. It does not have the same rigorous standards as the mandatory carbon market.

Aside from the voluntary carbon market, the regulatory carbon market is the only market in which carbon credits are regulated. The Kyoto Protocol, which was a global accord, established the first international carbon markets. This was followed by the Paris Agreement of 2015, which established national and international emissions targets. As a result, more countries are implementing cap and trade schemes.

In the United States, for example, the Environmental Protection Agency has issued the Renewable Identification Number. This is a credit generated when a gallon of renewable fuel is produced. Buying and selling a RI number has been a key part of developing the North American renewable fuels market.

The CFTC should evaluate the standards proposed by the private sector and determine whether they yield permanent and verifiable emissions reductions. Regardless of the result, it should make sure that the standard results in a real-world benefit to consumers, including consumers’ health, the environment and the economy.

It may not be a coincidence that carbon markets are often called the “bell weather of climate investment.” Climate investments include a variety of options, from sequestration in forests to reforestation. Although these investments are not a substitute for other approaches, such as conservation and restoration, they can create tangible environmental benefits. If companies can pay a fair price for these goods and services, it can be an important incentive for them to pursue these projects.

Carbon credits, however, can be more cost-effective than other methods. They are less complex to implement and can offer a better reward for environmentally conscious businesses.