Decentralized OTC Crypto Investment

OTC Crypto

Cryptocurrency is a new form of investment, based on a blockchain. These decentralized exchanges allow users to buy and sell digital assets, such as cryptocurrencies. These exchanges are booming, with June’s volume breaking the previous record month. As a result, these non-fungible tokens are finding applications beyond just digital investments. For example, non-fungible tokens have found popularity in the art world, with one piece of digital artwork selling for $55,000 by August 2020. And non-fungible tokens have become increasingly popular in gaming, such as those used in virtual worlds where players trade property and labor.

ICOs are a recent example. The ICO model gives investors the opportunity to support a project in exchange for a token. They can do so without a third-party oversight and can help move projects forward. Many companies have raised huge sums of money through ICOs. These exchanges often use atomic swaps to eliminate the middleman, allowing investors to sell their cryptos to other investors. A popular fiat-crypto exchange is Huobi OTC, which is located in Hong Kong and the United States. Individuals can use this exchange to trade digital assets.

Decentralized OTC crypto exchange

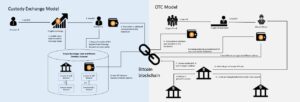

In contrast, decentralized exchanges do not require a middleman to ensure the security of their customers’ crypto. They use an order book and an automated market maker to match buyers and sellers. An order book is like a queue where the quantity and price of a transaction is entered, and a trade is made when a match is made. A decentralized exchange can continue running, even if the company goes out of business.

Decentralized OTC Crypto Investment

A decentralized OTC exchange allows high-net-worth investors to invest in digital assets without having to broadcast orders. In addition, OTC exchanges also offer anonymity for investors. This allows high-net-worth investors to invest without being exposed to broadcasted orders or identifying their real identity. As a result, high-profile individuals can make money without the hassle of broadcasting orders to the public. That means more anonymity, which is a vital aspect of decentralized crypto investment.

Some crypto enthusiasts are opposed to centralized exchanges. Some feel that they go against the spirit of decentralized crypto. Others argue that they may require Know Your Customer rules, which require users to reveal their true identities. This may prevent money laundering or fraud, but it also raises security issues. As such, a decentralized exchange might not be the best option for everyone. You may want to consider the advantages and disadvantages of each exchange.

The Wintermute Node aims to be a one-stop-shop for digital assets. The firm is launching a pilot in 2020 and has already transacted $300 million in trading volume. Its clients include institutions, high-net-worth individuals, and Bitcoin mining operations. Its minimum investment is $25,000, and it has partnerships with Coinbase, Ledger, and Silvergate. The company has a reputation for providing security and accessibility.